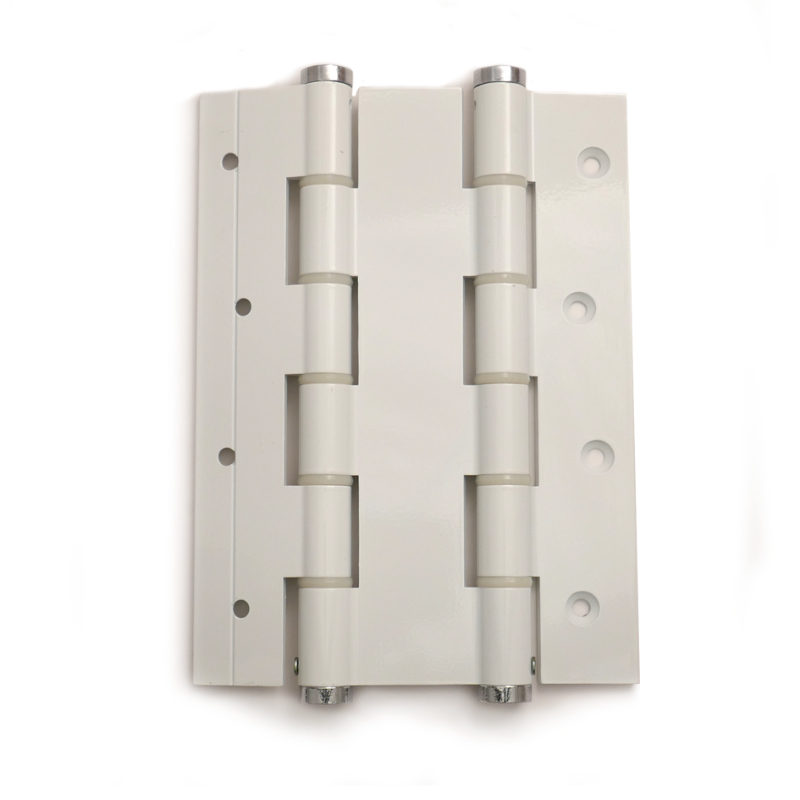

2 pièces/ensemble charnière à ressort Bisagra ferme-porte à fermeture automatique charnières de porte à retour automatique argent : Amazon.fr: Bricolage

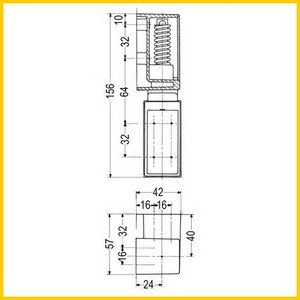

Ajuster Le Fauteuil Inclinable, 34N-50N 30-180° Ajustement Retour Charnière Inclinable Pour Camion Pour Sièges D'auto Modifiés | Walmart Canada

2 pièces/Ensemble charnière à Ressort en Acier Inoxydable Ferme-Porte à Fermeture Automatique charnières à Retour Automatique 4 Pouces : Amazon.fr: Bricolage

2 pièces-ensemble charnière à ressort fermeture automatique ferme-porte charnière de porte de retour automatique amortissement","i - Cdiscount Bricolage

BBGS Charnière de Porte 2 Pièces, Ferme-Porte À Fermeture Automatique À Ressort, Charnières de Porte de Retour Automatique Quincaillerie de Porte Accessoires de Quincaillerie Domestique : Amazon.fr: Bricolage

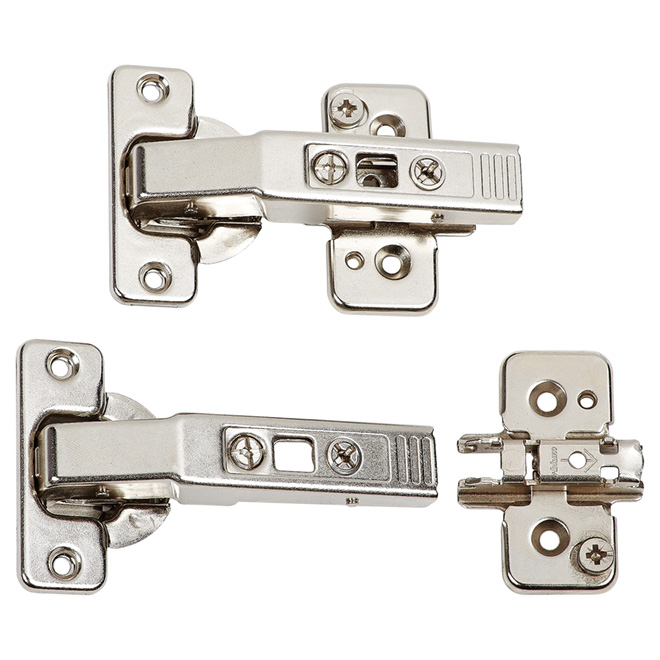

Charnière à fermeture automatique Clip de Richelieu, vissable, 95°, 4 po x 2 1/4 po, 2/pqt BP79T95523180 | RONA

Charnière de porte automatique pour congélateur étoile, cube de glace, charnière de porte d'armoire à neige, charnière de porte de retour de cuisine | AliExpress

Charnière à fermeture automatique de Richelieu, semi-dissimulée, métal, 2 3/4 po x 1 3/4 po, 20/pq AP134195 | RONA

2Pcs Charnière à ressort Ferme-porte à fermeture automatique Charnières à retour automatique-YUW - Cdiscount Bricolage

6 Pcs Charniere Porte Charnière à Fermeture Automatique Matériau en Acier Laminé à Froid Paumelle Ressort avec Amortisseur pour Porte Placard Armoire à Chaussures Bibliothèque Cave à Vin

2 pièces-ensemble charnière à ressort fermeture automatique ferme-porte charnière de porte de retour automatique amortissement","i - Cdiscount Bricolage